稅務走廊》稅務局寄發「退稅支票未兌領通知單」 提醒儘速兌領

Reporter Lai Rongwei/Hualien reported that

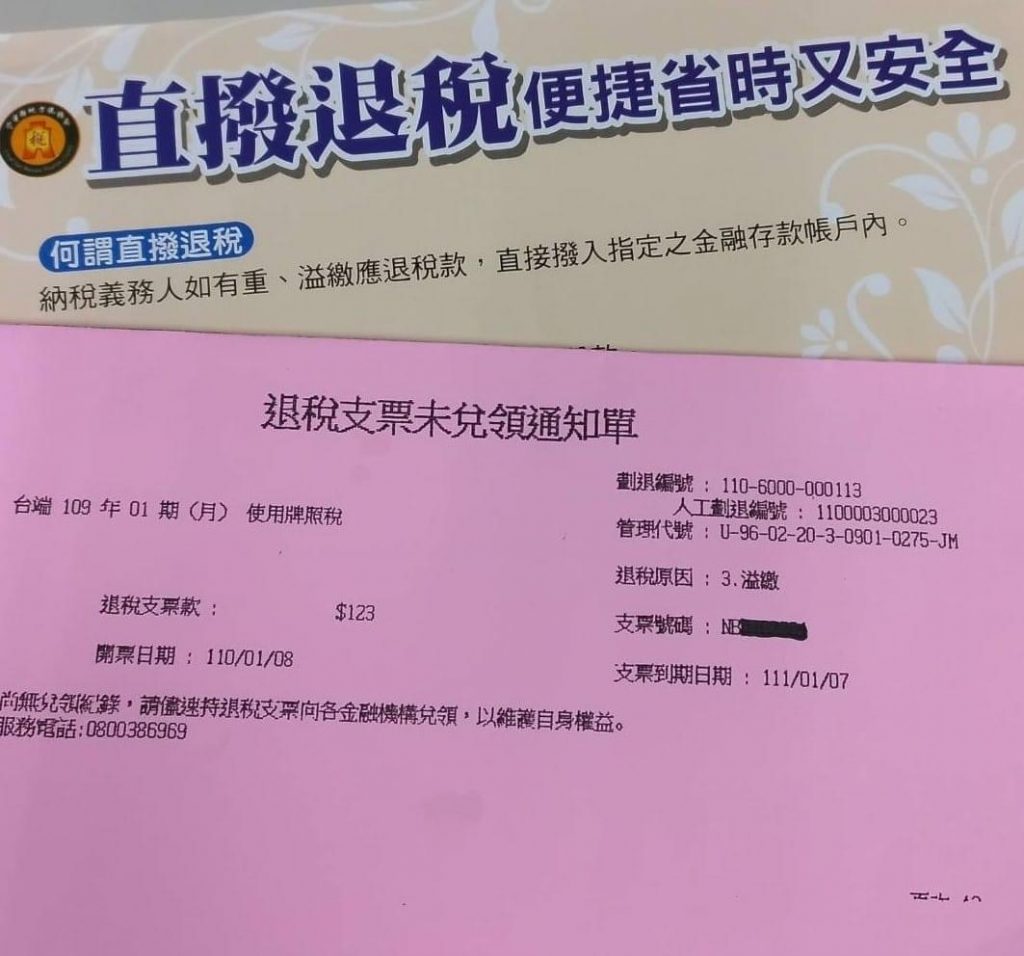

the Hualien County Local Taxation Bureau stated that in order to protect the rights and interests of taxpayers, the tax refund checks issued in 2011 have not been cashed, and in early November 2011, a “Notice of Tax Refund Check Not Cashed” has been sent to remind taxpayers Redeem as soon as possible.

The Bureau pointed out that if the tax refund check is not cashed for one year after the invoice date, the tax collection agency must handle the tax refund after the end of the year according to regulations. However, before the tax refund is released from the treasury, the taxpayer can still bring the overdue tax refund check to the tax bureau to change the invoice date or remit it to the designated account by direct dialing; It is cumbersome and time-consuming. Therefore, the bureau appeals to taxpayers who receive tax refund checks to redeem them as soon as possible at the public treasury bank or deposit them in the account of the nearest financial institution or post office, so as to avoid having to apply for tax refund again after being released from the treasury due to overdue redemption deadline.

The bureau once again reminded those who have not yet redeemed the tax refund check issued in 110, please remember to redeem it from the public treasury bank as soon as possible within the validity period for redemption at the end of this (111) year, so as not to affect their own rights and interests. If you have any doubts about the tax refund, please call the bureau’s toll-free service number 0800-386969 or switchboard 03-8226121 extension 315, and someone will serve you wholeheartedly. In addition, you can also visit the Bureau’s information website website: https// www.hltb.gov.tw to browse related information.

The post Tax Corridor” The Tax Bureau sent a “Notice of Unpaid Tax Refund Check” to remind you to redeem it as soon as possible appeared first on Minsheng Haobao .